Think you know your ICP? Try again.

Too broad. Still too broad.

Most companies’ ideal customer profile (ICP) is too broad and unfocused (I wrote about this in my last entry), but it’s expected. Narrowing down is hard because it’s counterintuitive.

In a famine, you can’t be picky about what you eat. If your company is struggling to drive sufficient demand, the gut reaction is to expand your surface area vs. focus in on a narrower segment. “It’s not exactly the perfect fit but if we just build this one thing we might close them.” Sound familiar?

This approach may help you close a few one off deals, but this creates distraction and will result in a diluted product/go-to-market strategy that is heavily inefficient and ineffective.

So how do you know if your ICP is specific enough? Let’s put it to the test. Try filling out this template out without any gaps:

“{{target persona}} at {{company vertical(s)}} companies with {{company size/revenue/funding}} employees, {{team attribute}}, and they are running into challenges with {{primary use case}}. They are currently {{existing solution(s)}} but {{why status quo/existing solutions aren’t sufficient}}.”

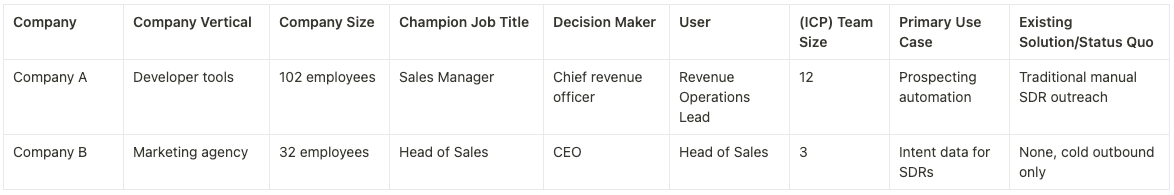

Here’s an completed example.

“Data engineers at e-commerce companies with over 100 employees and at least $5M in funding, who have more than 3 data engineers, and they are running into challenges with constant breaking changes that lead to unreliable data. They have instrumented bare-bones observability in-house or are using an existing data observability platform, but find it too disjointed from the rest of their data stack which leads to more inaccurate data downstream.”

Now let’s talk about how we arrive at such a detailed ICP.

The framework

If you’re early stage and don’t have enough data, skip this section and go to the ‘If you’re pre-product or only have a handful of customers’ section below

Step 1: Track firmographic and contextual attributes

The framework is simple - identify patterns and build segments among your prospects/customers, which will require you to tracking key attributes across your customers/prospects.

Here’s a sample template for an imaginary Sales SaaS product selling intent data (the reason you get “Noticed you were on our pricing page” emails from sales teams).

Most firmographic data can be easily enriched through a data provider like Apollo, but contextual information will need to be documented by your sales team or scraped (ie. for my company Paragon, one important attribute are the types of integrations the company already has).

Step 2: Cohort analysis across key metrics

Once you have this data on your deals and customers, you can begin to analyze patterns between cohorts, and attributes that lead to higher win rates / self-serve conversions if you’re PLG.

Here are the key metrics that I would look at across your different cohorts:

Closed Won Rate (or self-serve conversions in a PLG motion)

Net revenue retention (NRR)

Sales/Conversion Velocity

Average contract value (ACV)

To get the juices flowing, here are some prompts:

Do we see better win rates or conversions in certain cohorts {{ie. SMB/Mid-Market, PLG vs Sales led companies}}?

What product use cases have better win rates or are stickier (have better retention) than others?

Are there patterns between a company’s {{attribute}} and the primary use cases they come to us for?

Within the different use cases, do we see a higher win rate within specific verticals/segments?

Eventually, you’ll start to identify the winners and losers across your customer cohorts. But don’t forget to gut check the insights you get from the data with your customer-facing teams (customer success + sales) because let’s be honest, everyone hates filling out Salesforce so the data you have will be imperfect and lack sufficient context.

As Bezos says, “When the anecdotes and the data disagree, the anecdotes are usually right. There's probably something wrong with the way you are measuring it.”

As much as customer-facing teams’ perspectives are often influenced by recency bias, I’ve found that their anecdotal observations are still extremely valuable.

Once you’ve gone through the analysis and the gut check, and have ranked list of segments from best-fit to worst-fit, it’s almost time to solidify your new and refined ICP.

Step 3: Market Sizing

The last piece is understanding the market opportunity of your various segments. Hypothetically, if you have 40% win rates within a segment, but there are only 10 other companies in the world that fit the criteria, it’s probably not a worthwhile ICP to build your business around (unless you’re selling multi-million dollar deals).

All that to say, make sure to right-size the ‘fit’ of your different segments with the market opportunity that exists for each.

Now a few notes for early stage/pre-launch companies.

If you only have a handful of customers or are pre-product

User interviews are critical because you don’t have sufficient (or any) customer data to make decisions from. Leverage these interviews to help you understand the market and identify key fit indicators in the absence of actual customer data.

Make sure not to ask leading questions and leave your product out of it until the end. Instead, focus on asking about:

Their biggest pain points related to the problem set that you’re focused on —> indicator of use case

Of all their priorities, where does the problem rank in terms of urgency

How much they would be willing to pay to solve the problem

Who is held accountable in the team if the problem isn’t solved, and who has buying power

Any additional context that may be relevant to your identifying fit (tech stack, existing solution etc.)

Final step: Build your go-to-market and product strategy

By going through this process, you will end up with a refined ICP that the entire team will have conviction behind. This will bring clarity and serve as the backbone to all strategic decision-making across go-to-market to product, for example:

For Marketing: Targeting will be more focused, messaging will be tailored and hyper relevant to the ICP, and content will be built with the ICP in mind.

For Sales: Stricter qualification criteria will lead to more effective use of sales capacity and a sales process that is more repeatable. (discovery, demos, POCs).

For Product: Stronger clarity on who they’re building for will simplify prioritization decisions and make it easier to say no to feature requests that don’t support the core ICP.

Divergence between customers and your ICP

You may find yourself in a situation where a noticeable percentage of your existing customers don’t fit your newly defined ICP definition - don’t worry, that’s normal.

This is why I often tell early-stage teams not to over-index on customer feedback. More on this next week.